After a robust first half of 2024, the stock market has experienced a significant selloff, catching many investors off guard. This serves as a reminder that investing is never without risks. The confluence of economic uncertainties, geopolitical tensions, and valuation concerns has created a challenging environment for investors. However, this period of reassessment also presents opportunities for those who can navigate the volatility.

View More

Blog

Stock Market Reversal: FOMO or Keep Your Powder Dry?

July 18, 2024Online Financial Advice is (Mostly) Garbage

July 9, 2024In the digital age, the accessibility of information has dramatically increased, but so has the proliferation of misleading or outright incorrect advice. This is especially true in the realm of financial advice.

View More

San Diego High Rise Commercial Real Estate; Mid-Year 2024 Report

July 8, 2024The commercial real estate high-rise market in San Diego County continues to navigate a challenging landscape shaped by economic shifts, technological advancements, and evolving tenant preferences.Watch the video here:San Diego's commercial real estate high-rise market has shown resilience in the face of significant challenges.

View More

Debate Fallout: Investing In Dangerous Times

July 2, 2024Debate Fallout: Investing In Dangerous Times Last week’s Presidential Debate was a seminal event that will have far reaching impact.

View More

Gaslighting The American Investor

July 1, 2024Investors rely on accurate, transparent data to make informed decisions. However, in recent years, concerns have emerged regarding the integrity of economic data released by federal agencies. These concerns suggest that politicized federal agencies may have altered underlying accounting formulas to present a rosier picture of the economy than what would be revealed using original formulas.

View More

Private Equity Is The Party Over?

June 27, 2024Private Equity industry leaders are now declaring that the sector has moved beyond its high-water mark, entering a period of heightened risk and complexity.

View More

Investing ... How Much Are You Willing to Lose?

June 25, 2024Investment management is the art and science of balancing risk and reward, constantly walking the tightrope between aggressive gains and protective caution.

View More

Is AI Fraud? Is Corporate America Trying to Fool You?

June 20, 2024Artificial Intelligence (AI) has been heralded as the next revolutionary technology, promising to transform industries, redefine productivity, and reshape our daily lives. Corporate America, recognizing the financial potential of AI, has invested billions into its development and marketing. However, behind the glitzy presentations and ambitious claims lies a troubling reality: much of what is being touted as groundbreaking AI advancements are, in fact, exaggerated.

View More

Stock Market Returns In The Year After Presidential Elections

June 18, 2024In this post we’ll examine how stocks have performed since the 1920 elections.

View More

Federal Reserve Meeting Report: Higher For Longer

June 13, 2024The Fed ended its June meeting yesterday. My take on the usually opaque meeting report is that it was as benign as you could expect for a late stage election year. My call is that the Fed will hold interest rates steady till at least after the election if not through the remainder of 2024.

View More

Playing Catch Up On Retirement Savings

June 9, 2024Retirement planning is a critical aspect of financial management, and many find themselves facing the daunting realization that their retirement savings are underfunded. The need to catch up becomes pressing, especially for those who are closer to their retirement age and have limited time to build a sufficient nest egg.

View More

3 Essential Steps to Ensure Financial Freedom

June 7, 2024Congratulations on following the foundational steps and establishing a solid financial foundation.

View More

Your Financial Advisor's Investment Tips For The Election Year

June 6, 2024Election year! That chaotic carnival of mudslinging, lofty promises, and endless punditry. For the investment-savvy, risk-taking, politically sophisticated renaissance man-person, it's the perfect storm of opportunity and absurdity.

View More

Beware Commercial REITS: A Deep Dive Into Market Disruptions

June 5, 2024The commercial real estate (CRE) market is facing profound disruptions, particularly in the office space sector. Companies are abandoning office spaces en masse, seeking to downsize and reduce unused real estate. This shift has driven office availability rates in major cities to unprecedented levels, with some areas experiencing rates as high as 30%.

View More

Why June is Considered the Worst Month for the Stock Market

June 3, 2024The US stock market is known for its volatility, with various factors influencing its performance throughout the year. Among the twelve months, June has historically been considered the worst month for the US stock market.

View More

The #1 Threat Facing Your Retirement

May 30, 2024In today's economic climate, there are numerous challenges that can jeopardize your retirement plans. However, the most significant threat to your golden years is the overly rich valuation of financial assets.

View More

Summertime Rally? How to Capitalize on the Market's Seasonal Trends

May 29, 2024Summer! The season of sun, fun, and potential market mayhem. As sophisticated investors, we all know that the period from May to September can be as unpredictable.

View More

5 Reasons To Never Do A Roth IRA Conversion

May 28, 2024A Roth IRA conversion, while tempting for its promise of tax-free growth and withdrawals in retirement, is not always the best choice for every investor.

View More

The Demographic Tsunami: Riding The Wave of An Ageing Population

May 23, 2024Demographic changes are profoundly shaping the landscape of US investments, driving significant shifts in market dynamics and investment strategies. With an aging population and the evolving needs of younger generations, investors must navigate these trends to identify growth opportunities and manage risks. This demographic divergence influences various sectors, such as healthcare, technology, and infrastructure, necessitating a reevaluation of traditional investment portfolios.

View More

Busted in Retirement: The Tragicomedy of Financial Illiteracy

May 21, 2024In the grand theater of life, the DIY investor emerges as a central character, a well-intentioned but often misguided soul navigating the complex world of personal finance.

View More

The Dow Hits 40,000: What’s Next?

May 16, 2024The Dow Jones Industrial Average has reached a significant milestone, surging above the historic 40,000 mark in late morning and early afternoon trading.

View More

The 5 Phases of Retirement: The Emotional and Psychological Journey

May 16, 2024Retirement is a unique experience for everyone, but there is a common pattern that almost all retirements follow. There are distinct phases, each with its own challenges and opportunities. While the financial side of retirement is often discussed, the psychological and emotional aspects are not as frequently addressed.

View More

The Best Retirement Withdrawal Strategies for Optimizing a Secure Future

May 14, 2024Retirement marks the end of a long career and the beginning of a well-deserved reward for years of hard work.

View More

Outliving Your Money: How to Avoid Longevity Risk in Retirement

May 13, 2024Retirement is a time when individuals hope to enjoy the fruits of their labor, but it can also be a period of great concern, particularly when it comes to the risk of outliving one's savings. This fear, known as longevity risk, is a growing challenge as life expectancies continue to rise.

View More

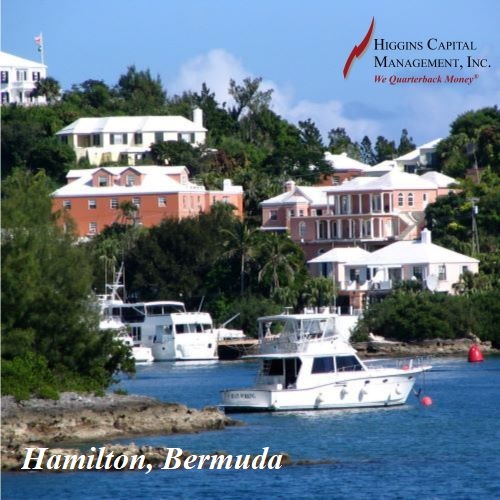

Leaving California, The Emotional Impact

May 10, 2024The decision to leave California after living in the state for an extended period can be a life-altering choice with significant emotional implications.

View More

Death and Taxes, Deal With It

May 8, 2024We live in a world where financial planning is as complex as ever, influencers and financial gurus often peddle convoluted schemes promising to minimize taxes during the golden years. From intricate investment structures to offshore accounts, the allure of paying less to Uncle Sam can be tantalizing.

View More

9 Retirement Investing Tips from Your Financial Advisor

May 7, 2024Seasoned investors approach retirement planning with a nuanced perspective, considering various facets of financial management for a secure and fulfilling post-career life. This guide explores key considerations that shape the retirement investing landscape for experienced individuals.

View More

Groundhog Day Investing - Déjà vu All Over Again

May 5, 2024War, Democrat Party Spoiler, Nifty vs Mags, Yippies vs Pro Palestine, Inflation, 1968 Markets returned 7.7%; cash is king during uncertain times, having a large cash position in 5% money markets may be a prudent investment approach in planning for future opportunity us US assets, reasons for optimism.

View More

Buying Gold: Survivalism vs Investing

May 3, 2024In today's investment landscape, the allure of gold shines brightly, especially amidst discussions of diversification away from traditional markets.

View More

It's The Fed, Stupid; The Fed Disappoints Wall Street

May 1, 2024It's The Fed, Stupid; The Fed Disappoints Wall Street. In 2024, Wall Street faces frustration as the Federal Reserve maintains its firm stance on monetary policy, echoing the sentiment: "It's the Fed, stupid."

View More

Stock Market Selloff: What's Driven The April Downturn?

April 30, 2024There are several potential reasons why the US stock market experienced a selloff in April 2024 after a strong first quarter.

View More

Understanding Bond Ladder Investing: A Comprehensive Guide

April 24, 2024Bond ladders provide investors with a strategic approach to fixed-income investing, offering a steady income stream, reduced interest rate risk, and increased flexibility.

View More

The Impact of Dividend Cuts on Your Investment Income

April 23, 2024Dividend income has long been a reliable source of investment returns, particularly for those seeking a steady stream of passive income. However, the stability of dividend income is not guaranteed, and investors must be aware of the potential risks associated with dividend cuts.

View More

Protecting your stock portfolio from inflation risk

April 22, 2024In this video, we'll explore the potential impact of persistent inflation and higher interest rates on US your investments.

View More

Dividends vs. Bond Coupons: Which Is Better for Retirement Income?

April 18, 2024In the world of creating a passive income stream, dividends and bond coupons are two distinct sources that investors often rely on. While both dividends and coupons provide regular cash flows to investors, there are crucial differences between the two that can significantly impact the stability and reliability of your income stream.

View More

Why Roth IRA Conversions Should Be Approached With Caution

April 17, 2024Traditional IRAs have long been a cornerstone of retirement planning, offering a range of benefits that make them an attractive choice for investors seeking financial security. While Roth IRAs and conversions have gained popularity, there are compelling reasons to approach these alternatives with caution.

View More

The Power of Secrecy: Advantages of Confidential Estate Planning

April 16, 2024In an era where transparency is often championed as a virtue, there remains a compelling argument for maintaining discretion, especially concerning your estate plans.

View More

Why Bother With Retirement? Rethinking the Sunset Years for Driven Men

April 15, 2024For decades, the prevailing narrative around retirement has painted it as the ultimate reward at the end of a long career - the promised land of relaxation, travel, and unlimited leisure time.

View More

Investors Reveal the Top 3 Challenges Facing the Stock Market Today

April 12, 2024As an investor, you understand the importance of adapting your investment approach to navigate the ever-changing market landscape. Many investors see the Top 3 Headwinds as: 1 inflation, 2 geopolitical uncertainty and 3 concerns about market valuations.

View More

Mortgage Rates Surge Past 7% as Inflation Persists

April 11, 2024The U.S. housing market has been grappling with a series of challenges over the past year, and the latest development is a stark reminder of the ongoing economic headwinds. Mortgage rates have once again surged past the 7% mark.

View More

Managing a Liquidity Event: A Comprehensive Guide

April 10, 2024When experiencing a liquidity event, such as an IPO, acquisition, or sale of a significant asset, it's essential to have a well-planned approach to manage the complexities and maximize the benefits of your newfound financial freedom.

View More

Frustrated with Your 401k? Higgins Capital Will Manage It for You

April 9, 2024As an investor you've experienced both success and failure in managing your 401k. But now you've come to the realization that managing your retirement investments is not as simple as you once believed.

View More

10 Critical Areas to Reassess in an 8% Interest Rate Environment

April 8, 2024Jamie Dimon, CEO of JP Morgan recently commented on the possibility of 8% interest rates. This should be taken seriously. 8% interest rates may be on the way. How will you cope?

View More

Bob Farrell's 10 Timeless Rules for Successful Investing

April 7, 2024Bob Farrell, a renowned Wall Street Investment Strategist, has distilled his decades of experience into ten insightful rules that encapsulate the essence of market behavior and investor psychology. These rules serve as a valuable guide for navigating the complex and often unpredictable world of investing.

View More

Target Date Funds: The Good, The Bad, The Ugly

April 5, 2024Target Date Funds: In today’s narrative of "set it and forget it" investing, investors are often told to trust the market. This is akin to leaving a newborn unattended or driving a car without checking the gas.

View More

Top 7 Mistakes to Avoid When Choosing an Estate Executor

April 3, 2024When creating an estate plan, selecting the right executor is a critical decision that can greatly impact the smooth and efficient settlement of your estate.

View More

Why Investors Must Brace for a Stock Market Correction

April 2, 2024For decades, Wall Street has relied on the Federal Reserve's accommodative monetary policy and the "Fed Put," which has led to complacency among investors. However, as Fed Chair Jerome Powell channels Paul Volcker's spirit, investors must recognize the risk of a significant stock market correction.

View More

What to Do with Leftover 529 Plan Funds: Your Options Explained

April 1, 2024For investors, managing leftover funds in a 529 plan requires careful consideration and strategic planning. Circumstances may arise where the designated beneficiary does not require the entire sum allocated for education. In such scenarios, exploring alternative options becomes imperative to optimize the use of these funds.

View More

Financial Panics and The Madness of The Crowd

March 30, 2024Financial history is rife with narratives of speculative fervor followed by devastating market collapses. From the tulip mania of the 17th century to the recent cryptocurrency bubbles, these episodes underscore the volatile nature of markets.

View More

What Do You Bring to the Table? You're the Client

March 29, 2024When it comes to the client-financial advisor relationship, the focus often lies on the advisor expertise and responsibilities. However, it's crucial to recognize that clients play an equally important role in shaping the success of the partnership.

View More

Protecting the Elderly from Financial Abuse: A Comprehensive Guide

March 28, 2024Protecting the Elderly from Financial Abuse: A Comprehensive Guide. Financial abuse is a common problem among the elderly. Billions are lost annually due to this issue. Here are the top 3 issues.

View More

Building a Lasting Legacy: Incorporating Your Values into Estate Planning

March 27, 2024Estate planning is not just about distributing your financial assets; it's about building a legacy that reflects your values and the essence of who you are.

View More

The Ultimate Guide to Bitcoin Halving: Everything You Must Know

March 26, 2024Understanding the intricacies of Bitcoin halving is crucial for making informed decisions and capitalizing on the potential opportunities that arise from this event. Bitcoin halving, which occurs approximately every four years, is a fundamental aspect of the design.

View More

9 Essential Factors to Consider Before Converting to a Roth IRA

March 25, 2024As retirement investors seek to optimize their savings and minimize their tax burden, Roth IRA conversions have become an increasingly popular strategy. A Roth IRA conversion involves transferring funds from a traditional IRA or employer-sponsored retirement plan, such as a 401(k), into a Roth IRA.

View More

The Alarming Rise of 401k Hardship Withdrawals

March 22, 2024The record-breaking surge in 401k hardship withdrawals is a disturbing trend that highlights the financial irresponsibility and lack of discipline among many American investors.

View More

The Future of Green Energy Investing

March 21, 2024The past decade witnessed an unprecedented surge in investments in renewable energy sources such as solar, wind, and other green technologies.

View More

The Diversification Trap: How Over-Diversification is Killing Your Returns

March 20, 2024Diversification has long been touted as the cornerstone of prudent investing, with the mantra don't put all your eggs in one basket. Watch the video.

View More

The Diversification Trap: How Over-Diversification is Killing Your Returns

March 20, 2024Diversification has long been touted as the cornerstone of prudent investing, with the mantra "don't put all your eggs in one basket" echoing through the halls of wealth management firms. While diversification can indeed help mitigate risk, the overuse of this strategy in investor portfolios can lead to lower performance.

View More

Concentrated Portfolios: The Bold Investment Strategy for Fearless Investors

March 19, 2024A concentrated portfolio is an investment strategy that involves investing a significant portion of an individual's assets into a limited number of holdings, typically consisting of a small number of stocks, bonds, or other securities. This approach differs from the more common diversified portfolio strategy.

View More

10 Surprises Retirees Wish They Knew Before Retiring

March 15, 2024Retirement is a significant milestone but it can also come with unexpected surprises. In this post I'll discuss the ten most common surprises that retirees discover after the fact.

View More

3 Essential Factors for a Fulfilling Retirement

March 14, 2024Envisioning Your Retirement Lifestyle. When contemplating your retirement lifestyle, it's crucial to look beyond the surface-level aspects of glamour versus modesty.

View More

Retirement Account Gold: Hidden Risks

March 13, 2024Physical gold as an investment option within retirement accounts presents a unique set of challenges and limitations that investors must carefully consider.

View More

7 Reasons To Retire Today

March 11, 2024The decision of when to retire is one of the most important decisions you will make. The personal complexities of the retirement decision range from financial and personal to aspirational.This video explores 7 reasons you should consider.

View More

Profitable Retirement Investing 5 Contrarian Revelations

March 9, 2024Retirement investing is not always about following the crowd or adhering to conventional wisdom. Overlooked advantages and contrarian strategies can potentially unlock significant profits and secure a comfortable retirement.

View More

Get Real – Late Stage Retirement Catchup: 4 Ways to Increase Performance

March 7, 2024Retirement planning is a crucial aspect of personal finance. As individuals approach their golden years, it becomes increasingly important to ensure that their investment portfolio is optimized for maximum returns.

View More

Retirement Income: Fixed Annuities or Bonds

March 6, 2024As investors approach retirement, one of the critical decisions they face is how to generate a reliable stream of income from their accumulated savings.

View More

Retirement Income: Fixed Annuities or Bonds

March 6, 2024As investors approach retirement, one of the critical decisions they face is how to generate a reliable stream of income from their accumulated savings.

View More

Retirement Income: Fixed Annuities or Bonds

March 6, 2024As investors approach retirement, one of the critical decisions they face is how to generate a reliable stream of income from their accumulated savings.

View More

Retirement Income: Fixed Annuities or Bonds

March 6, 2024As investors approach retirement, one of the critical decisions they face is how to generate a reliable stream of income from their accumulated savings.

View More

5 Reasons Social Security Will Never Be Cut

March 5, 2024Social Security stands as one of the most sacrosanct pillars of the American social safety net. For decades, it has provided financial stability and security for millions of retirees, disabled individuals, and survivors. Despite periodic debates and discussions about its sustainability and reform, there are several compelling reasons why Social Security will never be cut. We will explore 5 key reasons that underscore the enduring nature of Social Security in the American political landscape.

View More

How It Feels To Lose Money In The Stock Market

March 3, 2024Investing in the stock market is a rollercoaster ride of emotions, especially when financial losses occur. The experience of losing money in investments can lead to severe negative emotional responses that impact an investor’s personal well-being but will also affect family dynamics.

View More

Bitcoin Feeding Frenzy: What You Need to Know

March 2, 2024Talk of a Bitcoin feeding frenzy is again being heard on Wall Street. This volatile digital asset, once dismissed as a fringe experiment, has captured the attention of both seasoned investors and curious newcomers.

View More

Secrets to Retirement Investing In Volatile Markets

March 1, 2024The current investing market environment has introduced increased levels of uncertainty and volatility, posing a significant threat to retirement planning.

View More

Market Watch: Analyzing Stock Trends on February 27, 2024

February 27, 2024Market Watch: Analyzing Stock Trends on February 27, 2024

View More

Should You Invest in REITs? Top Pros & Cons Explained

February 26, 2024

Should You Invest in REITs? Top Pros & Cons Explained.

View More

Retirement Rescue: 5 Strategies for Building Your Underfunded Nest Egg

February 23, 2024Catching up on retirement savings requires a strategic approach.

View More

FOMO Are You A Player or a Talker?

February 22, 2024FOMO Are You A Player or a Talker?

View More

5 Things To Keep Out Of Your Will

February 20, 2024Estate planning is a vital aspect of preparing for the future, ensuring that your wishes are carried out and your loved ones are provided for after you're gone.

View More

Breaking the Myth: The Truth About the 4% Retirement Withdrawal Rule

February 16, 2024While the 4% retirement withdrawal rule has served as a guiding principle for retirement planning for decades, its efficacy in today's complex financial landscape is increasingly called into question.

View More

Avoiding Retirement Regrets: 3 Must-Know Tips for Men

February 15, 2024Retirement represents a unique life transition for men.

View More

The One Thing You Must Do For Your Children

February 14, 2024Give your children the priceless gift of knowing the location of your Estate Planning Binder.

View More

7 Reasons to Always Use a Prenuptial Agreement

February 13, 2024Marriage is often portrayed as the ultimate union of love and commitment between two individuals. However, It is also a legally binding contract with significant financial implications.

View More

5 Investing Opportunities During a Presidential Election Year

February 9, 2024US Presidential Election Years offer unique investing opportunities. This is the most contentious and unusual Presidential Election Year in memory. This election cycle, both candidates from the major parties face significant hurtles. Here are 5 possible trends to play into if you structure you portfolio for this unusual period.

View More

3 Important Reasons to Roll Your 401k into an IRA

February 8, 2024Rolling a 401k into an IRA is a simple process. When making the decision to roll a 401k, remember that it's crucial to weigh potential benefits against drawbacks.

View More

7 Reasons Not To Retire

February 8, 2024When planning retirement, individuals often find compelling reasons to continue working or even opt never to retire altogether.

View More

9 Retirement Planning Errors to Avoid

February 6, 2024Retirement planning is a complex and multifaceted process that requires careful consideration and proactive decision-making.

View More

The 3 Top Reasons to Take Your Social Security

February 4, 20243 Top Reasons to Take Your Social Security.

View More

Love and Money: 8 Ways to Manage Your Finances as a Couple

February 3, 2024Couples have various ways to structure their finances based on their preferences and circumstances. Here are 8 examples of how cohabitating couples may choose to manage their finances.

View More

Is ESG Investing Dead - Reassessing Its Viability

February 2, 2024Environmental, Social, and Governance (ESG) investing has gained visibility in recent years. However, a growing chorus of critics suggests that ESG investing is facing fundamental challenges that question its long-term viability.

View More

The Pros and Cons of Investing at Market Tops

January 31, 2024We've all heard the siren song of peak valuations. It echoes with the promise of windfall profits, of cresting the waves of euphoria while leaving the laggards far below.

View More

7 Charitable Giving Strategies for Investors

January 30, 20247 Charitable Giving Strategies for InvestorsInvestors understand that philanthropy can be a strategic tool to enhance their financial portfolios while making a positive impact on society.

View More

No One Ever Went Broke by Taking a Profit

January 26, 2024In the world of investing, the adage, No one ever went broke by taking a profit; attributed to Jesse Livermore, serves as a beacon for those navigating the intricacies of active portfolio management.

View More

7 Proven Money Rules I Wish I Learned in My 30s

January 26, 20247 Proven Money Rules I Wish I Learned in My 30s

View More

Financial Literacy for the Next Generation: Passing on Financial Wisdom to Heirs

January 19, 2024A part of your legacy is passing on financial wisdom to the next generation. This holds immense significance.

View More

Zen and The Art of Investing

January 18, 2024In the fast-paced world of aggressive investing, where markets fluctuate like the ebb and flow of the tides, applying the principles of Zen philosophy can be a transformative guide to achieving portfolio excellence.

View More

The Secrets of Recession Proof Investing

January 17, 2024A recession is here or it is coming. In the unpredictable tides of economic cycles, recessions emerge as inevitable storms, challenging even seasoned investors.

View More

High Yield Bonds Are They Right For Your Retirement Income?

January 16, 2024The world of high yield bonds, often dismissed as "junk," holds a unique allure for a certain breed of investor. This essay serves as a demystification for seasoned skeptics who appreciate the delicate balance between risk and reward.

View More

5 Reasons to Question Climate Change Investing

January 11, 2024In the clamoring chorus of climate change activism, a dissenting voice arises – the voice of the cautious investor, the measured analyst, the pragmatist. While the urgency of environmental action resonates with many, a closer look at the proposed solutions reveals cracks in the narrative, uncertainties that demand a healthy dose of skepticism.

View More

5 Reasons to Beware The Magnificent 7

January 7, 2024The stock market, once a diverse ecosystem of competing companies, has morphed into a landscape dominated by a select few titans. Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), Tesla, and NVIDIA, aptly dubbed the Magnificent 7, now exert an outsized influence on major indices.

View More

Demystifying High Yield Bonds: A Refresher on Junk Bonds for Savvy Investors

January 3, 2024In the realm of fixed-income investments, high yield bonds have long been a subject of intrigue and trepidation among investors.

View More

La Jolla Shores Goes Off

January 1, 2024Surfing is a metaphor for what makes life worth living.

View More

Is The Coming Bitcoin ETF Right for Your Retirement Plan?

December 20, 2023Investors are constantly seeking new opportunities to diversify their portfolios and enhance returns. One emerging asset class that has garnered significant attention is Bitcoin.

View More

5 Capital Preservation Strategies in an Ageing Bull Stock Market

December 17, 20235 Capital Preservation Strategies in an Ageing Bull Stock Market.

View More

401k Rollovers How To Do Them and What to Expect

December 15, 2023Maximizing your retirement: The ultimate guide to 401k rolloversNavigating the intricacies of retirement planning, particularly when contemplating a 401k rollover, can be a daunting task.

View More

The Impact of Inflation on Retirement Savings

December 13, 2023Retirement planning is a critical aspect of financial management, requiring careful consideration of various factors that can influence the efficacy of your savings. One such factor that often flies under the radar but can have a profound effect on retirement funds is inflation.

View More

The Different Investing Habits of Men vs Women

December 11, 2023The investment habits among men and women in the 40+ age group reveals differences influenced by risk tolerance, time horizons, investment strategies, financial knowledge, and priorities.

View More

The Emotional Side of Wealth: Managing Fear and Greed

December 8, 2023In the ever-fluctuating world of finance, where markets dance to the tunes of unpredictability, one constant remains – the emotional roller coaster that comes with managing wealth.

View More

Uncovering the Silent Financial Crisis Inside America

December 7, 2023Beneath the surface of glossy economic reports and rosy market projections, a silent financial crisis lurks in America, one whose magnitude is only starting to be grasped.

View More

Early Retirement The Ultimate Guide

December 6, 2023Embarking on the journey of early retirement is not just a financial decision.

View More

Maximizing Retirement Contributions: Strategies for High Net Worth Individuals

December 4, 2023The importance of strategic retirement contributions is emphasized, underlining the impact of contribution decisions on long-term wealth and advocating for early and consistent contributions.

View More

6 Reasons to Consolidate All Your IRAs Into One Account

November 29, 2023Consolidating multiple IRAs into a single account offers investors unparalleled control over their retirement savings, steering the course towards financial empowerment and efficient estate planning.

View More

The Thanksgiving Mindset for Successful Retirement Investing.

November 22, 2023

A Thanksgiving Mindset is not just a fleeting emotion; It is a powerful tool that can transform your perspective, enhance your self-awareness, and empower you to make more informed decisions in all areas of your life, including your retirement.

View More

5 Videos on Retirement Investing

November 16, 2023

Here are 5 videos on various aspects of retirment investing:

View More

We've Created 3 Videos For You

November 9, 2023

We've Created 3 Videos For You. View Them Here.

View More

Annuity Basics – Features and Benefits

November 2, 2023

Annuities are a financial product that plays a pivotal role in retirement planning and estate management.

View More

Liquidity and Money Market Funds: Why You Need Them and How to Use Them

October 26, 2023

Successful investors recognize the value of a well-structured money market strategy in mitigating stock market risk, especially in down markets.

View More

Manna and The Punch Bowl

October 19, 2023Today, we heardToday, we heard Fed Chair Powell reiterate his message of higher for longer. Now the media narrative is that a Fed Pause will bring manna. We take exception to this narrative.

View More

The October Effect: 5 Facts You Need To Know

October 4, 2023

The October Effect: 5 Facts You Need To Know

View More

The Stock Market: Must Know Year End Seasonal Patterns

September 1, 2023

There are 5-Seasonal Stock Market Patterns.

View More

"I made a lot of money ..."

August 1, 2023George Soros made a billion dollars in one day shorting the pound.

View More

Receive Great Content on Our Different Channels

May 1, 2023

We're Making Changes. We're migrating content to the following platforms. YouTube: Twitter: LinkedIn.

View More

Lessons From Silicon Valley Bank

March 11, 2023Here are lessons from the failure of Silicon Valley Bank.

View More

ChatGPT - An Opinion

February 28, 2023I discovered ChatGBT 2-weeks after it launched. This is my second opinion piece on the technology.

View More

The Fed Minutes from February 01, 2023 were released today.

February 22, 2023

Expect higher interest rates for longer.More headwinds for markets and the economy.

View More

Markets are continuing to frustrate investors. Up, Down, Sideways.

February 15, 2023

After a strong January, markets are faltering in the face of stronger than expected inflation data.

View More

The Fed Raises Rates 1/4 Point

February 1, 2023

Today, the Fed Raised Rates 1/4% (25 Basis Points).

View More

Annual Market Review 2022

January 3, 2023

Annual Market Review 2022 The year 2022 may best be described by one word: inflation. The economies of the United States and the world were influenced by rising inflation, its causes, and the policies aimed at curtailing it.

View More

2022 Was A Year For The Record Books

January 2, 2023

In the markets, bonds had their worst year ever. Stock indices were down about 20%. Is the carnage over?

View More

More Fun With Technical Analysis!

December 16, 2022

I've been sharing this price chart of the S&P 500 as the downward sloping, sawtooth price pattern has developed, since the high in December 2021.Since my last chart, the S&P has now failed to penetrate resistance for the 4th time.This signifies an increasingly bearish market.

View More

Where’s Your Future?

December 13, 2022

Nothing lasts forever. You know this.This is particularly true with the future of financial markets.Passive Investing is last year’s game.

View More

Understanding Powell’s Fed-Speak.

December 1, 2022

The world held its breath as Fed Chair Powell spoke about inflation and interest rates. When all was done, stocks and bonds loved what they heard.

View More

Inflation Is Forcing Higher Interest Rates Into Your Future.

October 31, 2022

Central Banks around the world are rushing to walk back years of failed MMT policy. Global economies will pay for the policy failures.

View More

The Economy is Bigger Than The Midterms

October 26, 2022The U.S. Economy is too big to be meaningfully impacted by the mid-terms.However, we do see an increased possibility of a year-end rally regardless of mid-term results.

View More

Return of The Bond Vigilantes

October 16, 2022What Is a Bond Vigilante? Bond Vigilantes are fixed income traders, at financial institutions, who express their displeasure with a government or corporate policy by attacking the offending entity.

View More

Stories From The Inheritance Files

October 5, 2022

The Queen's Will was apparently changed recently and is now causing heartburn among some Royals.Proof that it happens in all families.

View More

Quarterly Market Review: July-September 2022

October 4, 2022

The ramifications of stamping down rising inflation dominated the markets in the third quarter.

View More

3-Reasons The Fed Will Continue to Raise Interest Rates.

September 28, 2022

After more than a decade of low interest rates, the Federal Reserve has changed course.Fighting inflation is the New Black.Take heed.Forewarned is forearmed.This year, Fed Chair Powell has repeatedly said that he will do whatever it takes to control inflation.

View More

Caring For Ageing Parents

September 1, 2022

Broken Family Relationships Are Normal. Times of family stress may bring them out.

View More

Fed Raises Interest Rates 75 basis points (3/4%)

July 29, 2022

This week'is week's 75 basis point rate hike is only the second back to back 75 basis point hike in 40-years.

View More

The First Half of 2022 Was One For The Record Books.

July 5, 2022

Despite an end-of-week surge, stocks closed last week lower. Recession fears resulted in traders moving to bonds ... .

View More

Stocks Remain Volatile

May 31, 2022

Stocks closed higher last week, ending a seven-week slide. More upbeat corporate news and favorable economic data helped quell investor angst, at least temporarily.

View More

Is This A Bear? Or is it Another Critter?

April 29, 2022

Is This A Bear?Or is it another critter? The stock market has been weak for more than 4-months.

View More

Markets Are Trading Ukraine Uncertainty.

February 28, 2022

Stocks are doing what they do best: evaluating data and pricing outcomes. Friday's relief rally was long overdue.

View More

Market Month: January 2022

February 2, 2022

Stocks ended January lower as investors dealt with concerns over inflation, rising interest rates, and global economic recovery.

View More

Teach Your Children Well.

January 25, 2022

Teach Your Children Well. Denzel Washington said it all, "It starts at home. It starts with how you raise your children."

View More

The Markets as of market close January 21, 2022

January 24, 2022

Volatility hit the markets this month; impacted by a more hawkish Federal Reserve stance, economic disruptions from Omicron, and risks to company profits due to rising costs.

View More

Pull Back, Correction, Bear, Crash?

January 21, 2022

Markets continue to sell off … and we haven’t seen the dip-buyers yet.

View More

Forgiving Student Loans.

January 20, 2022

We've been hearing about the movement to forgive student loans.

View More

The Markets.

January 18, 2022Global Markets Investing.

January 15, 2022

Diversification into global markets is fundamental prudent asset allocation.The degree of that diversification is determined by your risk profile.

View More

2021 Annual Market Review.

January 14, 2022

2021 was a memorable year.

View More

Here Are Key Tax Reference Numbers for 2022.

January 13, 2022Market Week: January 10, 2022

January 10, 2022

Last week began on a high note, but stocks couldn't maintain that momentum, ending the week in the red. Read More.

View More

What Is Going On With Stocks and Mortgage Rates??

January 7, 2022

What Is Going On With Stocks and Mortgage Rates?? Understanding markets is like understanding this photo.The Fed has made it clear that they will be raising interest rates.

View More

Tax Loss Selling

December 17, 2021

Happy Holidays and Happy New Year! It's That Time of Year.Out witht the old. In with the new.This means tax loss selling as financial assets are repositioned.

View More

Merry Christmas and Happy Holidays from Little Italy!

December 15, 2021

Little Italy is one of San Diego's best kept secrets. San Diego residents head to Little Italy for charm, ambience and that home-town feel. Come on down for some Italian Christmas Cheer.The best cannoli and the best spumoni in San Diego.

View More

Bitcoin is Upside Down!

December 14, 2021

Bitcoin is Upside Down! Where is Rudolph When You Need A Lift? Today's 9% inflation PPI print has financial markets feeling unstable as we close the year.Investors are hoping that Santa comes through with his annual year-end rally.Bitcoin is down 31% in the past month. This is how bear markets feel ... no parachute.

View More

Market Week: December 13. 2021.

December 13, 2021Stocks closed last week higher for the first time in three weeks. The S&P 500 enjoyed its best weekly gain since February.

View More

Happy Holidays from The Higgins Family to Yours!

December 10, 2021Happy Holidays from The Higgins Family to Yours! If you're looking to spike your Season in San Diego, try visiting our great hotels for their Christmas displays. Their lobbies are full of beauty and good cheer.

View More

Caring for Your Aging Parents

December 9, 2021Caring for Your Aging Parents. Caring for your aging parents is something you hope you can handle when the time comes. But it's the last thing you want to think about. Whether the time is now or somewhere down the road, there are steps that you can take to make your life (and theirs) a little easier.

View More

2021 Year-End Tax Tips

December 8, 2021Good Morning and Happy Holidays! Thanks for being an engaged reader! We are growing and looking for new clients. If we can help someone you know, please send them our way. Here are some things to consider as you weigh year-end tax moves.

View More

Market Week: December 6, 2021

December 6, 2021

Market Week December 06, 2021, As of market close December 3, 2021.Wall Street could not maintain its early momentum, closing the week down.

View More

Are you happy with financial advisor?

December 3, 2021

Year End is a time of reflection and renewal. Are you happy with financial advisor? You can do better.

View More

Supply-Chain Chaos: Holiday Edition

December 2, 2021

The supply chain is the network by which products flow from the factories to consumers. Corporate supply chains have been under pressure since the pandemic began.

View More

Market Month: November 2021

December 1, 2021

The Markets (as of market close November 30, 2021)Stocks ended November generally lower, with only the Nasdaq able to eke out a gain.

View More

Social Security Announces Biggest COLA in 40-Years.

November 30, 2021Higgins Capital Market Week: November 29, 2021

November 29, 2021

Higgins Capital Market Week: November 29, 2021. The Markets (as of market close November 26, 2021)Thanksgiving week was a tumultuous one for investors.

View More

Choosing a Beneficiary for Your IRA or 401(k)

November 18, 2021

Selecting beneficiaries for retirement benefits is different from choosing beneficiaries for other assets such as life insurance. Most inherited assets such as bank accounts, stocks, and real estate pass to your beneficiaries without income tax being due.

View More

Is Your Retirement Income Secure?

November 16, 2021

Common Factors Affecting Retirement Income:With regards to your retirement income, These are some common factors that can affect how much you will have available to spend.

View More

The Markets as of market close November 12, 2021

November 15, 2021

Each of the benchmark indexes lost ground this week. Inflation concerns weighed on investors' minds during the week.

View More

Celebrate Veterans Day

November 11, 2021~002.jpg)

November 11th is celebrated worldwide as the day The Armistice was signed that ended hostilities of World War 1. “The eleventh hour of the eleventh day of the eleventh month … 1918.”

View More

Happy Birthday U.S. Marine Corps!

November 10, 2021

Happy Birthday Marines! 246-years of Glory. From The Halls of Montezuma ...

View More

Our 34th Anniversary: A Tribute to My Wife Debbie

November 9, 2021

Our 34th Anniversary: A Tribute to My Wife Debbie.

View More

The Higgins Capital Market Report 11/08/2021

November 8, 2021

What is Old Is New Again.The first week of November saw stocks climb higher on the strength of favorable corporate earnings data, strong job growth, a dovish policy statement from the Federal Reserve, and favorable news on the battle against COVID-19.

View More

Hire The Right Financial Advisor

November 5, 2021Hire Experience. Hire Excellence. Hire Higgins Capital.... Helping Investors since 1996.

View More

Bonds, Interest Rates, and the Impact of Inflation

November 4, 2021

There are two ways that you can profit from owning bonds: from the interest that bonds pay, and from any increase in the bond' price. Many people who invest in bonds because they want a steady stream of income are surprised to learn that bond prices can fluctuate. If you sell a bond before its maturity date, you may get more than its face value; you could also receive less if you must sell when bond prices are down.

View More

Have You Checked Your Retirement Plan Recently?

October 27, 2021

Have You Checked Your Retirement Plan Lately?

View More

Annuities Within IRAs

October 26, 2021

An annuity is one of the investment options available for your IRA. Why invest your IRA in an annuity?

View More

Market Week: October 25, 2021

October 25, 2021Market Week: October 25, 2021 Each of the benchmark indexes listed here advanced last week. Corporate earnings data for the third quarter has gotten off to a solid start pushing stocks higher.

View More

Bitcoin, Crypto Currencies and Digital Assets

October 22, 2021

Bitcoin and Crypto Currencies have been headline news all week. They are examples of Digital Assets. We see Digital Assets as being where the internet was in 1995: A new, largely unregulated, disruptive technology.

View More

How Women Are Different from Men, Financially Speaking

October 21, 2021

We all know men and women are different in some fundamental ways. But is this true when it comes to financial planning? In a word, yes.

View More

Market Week 10/18/2021

October 20, 2021Despite a shaky start, Wall Street enjoyed a strong week of gains. A favorable start to corporate earnings season helped lift equities higher. Each of the benchmark indexes posted solid weekly gains.

View More

Crypto Futures Based ETFs Trick Or Treat?

October 19, 2021Digital Assets are in the news with today's launch of the first digital-asset ETF. The response to this asset class has been split along generational lines.

View More

We’ve Been Helping Investors For Decades!

October 15, 2021

Trust. Accountability. Transparency. Higgins Capital Management, Inc. 2223 Avenida de la Playa, Ste. 210 La Jolla, CA. 92037 Phone: 858) 459-2993 Text: (858) 251-6873.

View More

MARKET WEEK: OCTOBER 11, 2021

October 14, 2021MARKET WEEK: OCTOBER 14, 2021: Stocks closed last week generally higher, despite a weak jobs report. A poor showing last Friday was not enough to prevent the benchmark indexes from closing the week mostly in the black.

View More

Visit Our Video Library! Be Informed!

October 8, 2021

Video Madness! Either Or!Either Life is Good and You're Confident that The Good Times Will Continue Without End ...Or You Are Concerned About What The Future Holds and Want to Learn More About Your Choices.

View More

Strong and Kind

October 7, 2021

Strong and Kind. On Sunday a woman in New York City accidentally threw out her diamond wedding ring. She realized it in the middle of the night, and did the only thing she could think of, she left a NOTE on the windshield of a parked garbage truck.

View More

What Is A Bond Ladder?

October 6, 2021What Is A Bond Ladder? A bond ladder is a strategy involving the purchase of bonds that have staggering maturity dates. Instead of maturing all at once, the bonds mature in intervals.

View More

Converting Savings to Retirement Income

October 5, 2021

Converting Savings to Retirement Income. During your working years, you have probably set aside funds in retirement accounts such as IRAs, 401(k)s, or other workplace savings plans, as well as in taxable accounts. Your challenge during retirement is to convert those savings into an ongoing income stream that will provide adequate income throughout your retirement years.

View More

Market Week: The Markets (as of market close October 1, 2021)

October 4, 2021

The Markets (as of market close October 1, 2021)A rally last Friday helped drive stocks generally higher last week.

View More

Back to Basics: Diversification and Asset Allocation

October 1, 2021Back to Basics: Diversification and Asset Allocation. When investing, particularly for long-term goals, you should use Diversification and Asset Allocation.

View More

The Most Personal Charity Work You Can Do!

September 30, 2021Donate Blood.It is the most intensely personal contribution you can make. Just you, quietly giving back. You are saving lives today.

View More

Tips for Women Who Are Living in the Sandwich Generation

September 29, 2021

At a time when your career is reaching a peak and you are looking ahead to your own retirement, you may find yourself in the position of having to help your children with college expenses or the financial challenges of young adulthood while at the same time looking after the needs of your aging parents.

View More

The Markets (as of market close September 24, 2021)

September 27, 2021

Investors rode a bumpy ride, opening last week lower only to rebound later but not enough to avoid a third consecutive weekly dip. The Dow and the Global Dow fell nearly 1.0%, while the S&P 500 and the Russell 2000 declined more than 0.8%. Read on.

View More

INFLATION!!!

September 25, 2021

It's Here! Be Clear! Get Use To It! It may be transitory. Maybe Not.

View More

Celebrate!

September 24, 2021

Celebrate! Today is Native American Day.Debbie is a card-carrying member of the Monacan Indian Nation. Yep, with her blue eyes!

View More

Retirement Income: The Transition Into Retirement

September 23, 2021

Are You Ready to Retire? The question is actually more complicated than it first appears, because it demands consideration on two levels. First, there is the emotional component. Second, there is the financial component.

View More

Dazed and Confused??

September 22, 2021

Dazed and Confused?? You are looking at what surfers call The Spin Cycle. Vertigo. It's September. The month for vertigo in financial markets. If you have the jitters, turn off your TV and YouTube. Go for a walk and enjoy our beautiful fall weather.

View More

Scripps Pier – Golden Hour

September 17, 2021Scripps Pier At Golden Hour. After an inspired day with clients. The view through the double colonnade symbolizing the passage through life. From present to future. From one phase of to another.

View More

Have You Checked Your Retirement Plan Lately?

September 16, 2021

It is generally a good idea to review your employer-sponsored retirement savings plan at least once each year and when major life changes occur. If you haven't given your plan a thorough review within the last 12 months, now may be a good time to do so.

View More

Gaze Upon Tomorrow.

September 15, 2021This is Our Future.This is Our Tomorrow.This is Our Reason for Optimism.This is The Millennial Generation.

View More

Avatar The Movie 2009

September 13, 2021Watch This Stunning Movie Again.Avatar 2009.Did You Watch This Movie When It Was Released in 2009? This ground breaking movie was ahead of its time in 2009. It plays as well today as it did on its original release.

View More

Low Tide At Scripps Pier - The Natural Cycle of Things.

September 10, 2021Low Tide At Scripps Pier - The Natural Cycle of Things. Almost everything is cyclical. Nature, Life, Global Relationships, Economics, Power. Unusual times usually signal a change in a macro cycle.

View More

VIDEO ALERT!

September 8, 2021

We just posted our Video Review of August's Market Action on the Higgins Capital Facebook Page and on our LinkedIn Page.Take a look at it. If you are within 10-years of retirement you should include safety of principal in your risk profile. You can partially address this by having a Growth and Income Profile more skewed to Income. We manage Risk and Opportunity. Remember, “It doesn’t matter what you make. Only what you keep!

View More

Today is VJ Day, Victory Over Japan, September 02, 1945

September 2, 2021

Today is VJ Day. Victory Over Japan on September 2, 1945. History doesn't repeat; but it rhymes.

View More

Labor Day 2021 Is Here

September 1, 2021

Labor Day 2021 Is Here. This coming Monday, September 6 is Labor Day. The holiday pays tribute to American workers.

View More

A Retirement Income Roadmap for Women

August 25, 2021

More women are working and taking charge of their own retirement planning than ever before. What does retirement mean to you?

View More

Liars Logic - Trust Your Gut

August 24, 2021

Liars Logic! Usually from your 6-year old.... or from others caught red handed.

View More

Women! First and Always.

August 23, 2021

Women! First and Always. Women have complex and unique financial needs. Are yours being met?

View More

Are Government Savings Bonds Risk Free?

August 18, 2021

Life Is Risk. For everyone in every situation. Always. We all know that there is No Free Lunch. We should all know that there is No Risk Free Life. All bonds (fixed income) are subject to risk.

View More

Women and Estate Planning Basics

August 17, 2021

When it comes to estate planning, women have unique concerns. The fact is that women live an average of 5-years longer than men. That is important because it means there is a greater chance that you need your assets to last for a longer period of time and a greater need to plan for incapacity.

View More

Four Things Women Need to Know about Social Security

August 16, 2021

Women have been counting on Social Security to provide much-needed retirement income since 1940. Social Security provides 3 other important benefits.

View More

What Is Inflation and Why Should You Care About It?

August 11, 2021

What Is Inflation and Why Should You Care About It?Prices: Up, up and awayInflation occurs when there is more money circulating than there are goods and services to buy.

View More

Our Olympians Bring Home The Gold, The Silver and The Bronze

August 10, 2021

Our Olympians Brought Home The Gold, The Silver and The Bronze.A total of 113 Medals.

View More

Why Women Need Life Insurance

August 6, 2021

Today, women have more financial responsibilities than ever before. How will your family or loved ones manage financially if you die? Whether you are single, married, employed, or a stay-at-home mom, you probably need life insurance.

View More

Nuts and Bolts: How to Roll Over Your Employer Retirement Plan Assets

August 4, 2021

There are two types of rollovers: direct and indirect. A direct rollover is paid from your plan directly to your IRA or to your new employer's retirement plan.

View More

July Market Review

August 3, 2021

July 2021 Market Review

View More

Do You Have The Right Priorities?

August 2, 2021

Do You Have The Right Priorities?Family? Money? Love? Power? When was the last time you updated your priorities?

View More

Investing in Art, Antiques, Gems and Collectibles

July 30, 2021 Investing in Hard AssetsHard assets, such as art, antiques, gems and collectibles, are another way to diversify your holdings. Because hard assets often retain their value as inflation rises, they can provide balance to other asset classes that suffer more from rising costs.

View More

Clarity With Consolidation

July 28, 2021Do you keep your clean socks in 4-different rooms in your house? No.Why not?Because you want to know what you have ready to wear. It pays to know what you have where.

View More

STARBOARD!! We're Racing to Finish Your Story

July 27, 2021

We have focused on Retirement Investing and Planning for the past month. As fiduciary financial advisors we are racing to get you on the right course.

View More

Women and Work: Why Salary, Benefits, and Work-Life Balance Count

July 23, 2021

As women progress along their career path, there is no telling how far you will go. But to fully reap the financial rewards of all your hard work, you'll need to take charge of your own career.

View More

Lump-Sum Distribution from Inherited IRAs and Retirement Plans

July 21, 2021

Lump Sum Distributions from an IRA or Retirement Plan. A lump-sum distribution is the withdrawal of the entire balance of an inherited traditional IRA or employer-sponsored retirement plan account in one tax year.

View More

IRA and Retirement Plan Distributions

July 16, 2021

What is it?IRAs and employer-sponsored retirement plans (e.g., 401(k) and profit-sharing plans) play a central role in retirement planning. After all, the tax benefits are hard to beat.

View More

Learn From History! Why Reinvent The Wheel?

July 15, 2021

As we move through life, we learn that the one thing we will never have is enough time.

View More

Puzzled About Annuities as an IRA Investment Option?

July 14, 2021

A deferred annuity is one of several investment options you can choose from to fund your IRA.

View More

Converting Savings to Retirement Income

July 13, 2021

During your working years, you set aside funds in retirement accounts such as IRAs, 401(k)s, or other workplace savings plans, as well as in taxable accounts. Your challenge during retirement is to convert those savings into an ongoing income stream.

View More

Converting or Rolling Over Traditional IRAs to Roth IRAs

July 8, 2021

Converting or Rolling Over Traditional IRAs to Roth IRAs. What is it? In general, you can transfer all or a portion of your traditional IRA funds to a Roth IRA. Learn more here.

View More

SECURE Act Changed IRA and Retirement Plan Inheritance Rules

July 7, 2021

The SECURE Act changed IRA distributions and estate planning strategies. This piece will give you ideas on how to move forward with these changes.

View More

How Women Are Different from Men, Financially Speaking

July 1, 2021

We all know men and women are different in some fundamental ways. But is this true when it comes to financial planning? In a word, yes.

View More

Planning for Marriage: Financial Tips for Women

June 30, 2021

Planning for Marriage: Financial Tips for Women

View More

Retirement Plan Considerations at Different Stages of Life

June 29, 2021

Retirement Plan Considerations at Different Stages of Life. Throughout your career, retirement planning will likely be one of the most important components of your overall financial plan.

View More

Charitable Contributions from IRAs

June 25, 2021

Did you know that, if you are at least 70 1/2 years old, you can make tax-free charitable donations directly from your IRA? Has your Financial Advisor shared this strategy with you yet?

View More

Breakfast of Champions!

June 24, 2021

As your Financial Advisors you know that we work hard for you. Our office bowl of M&Ms gives a friendly boost to the office environment. It shows that humor and hard work are compatible.

View More

Should I invest in a Roth IRA or a traditional IRA?

June 23, 2021

There is no easy answer to this question. Traditional IRAs and Roth IRAs share certain general characteristics. As fiduciary financial advisors we recommend that you read this timely piece.

View More

Choosing a Beneficiary for Your IRA

June 22, 2021

Selecting beneficiaries for retirement accounts is different from choosing beneficiaries for other assets such as life insurance. The Higgins Capital Fiduciary Financial Advisors will help you.

View More

Tough Guys

June 21, 2021

Tough Guys … Badder and Madder Than Anything Hollywood Can Conjure. From Tom Brokaw's Greatest Generation.

View More

The Traits of a Good Investor and How Women Can Make the Most of Them

June 18, 2021

The Traits of a Good Investor and How Women Can Make the Most of Them. Many women work with their Financial Advisor to manage their money. Advantageous investor traits include: patience, willingness to confront mistakes and recognizing when help is needed.

View More

Luck Matters!

June 17, 2021

LUCK MATTERS! Summer has arrived in La Jolla!

View More

IRA and Retirement Plan Limits for 2021

June 15, 2021

IRA and Retirement Plan Limits for 2021The maximum amount you can contribute to a Traditional or Roth IRA in 2021 is $6,000 unchanged from 2020. The maximum catch-up contribution for those age 50 or older remains $1,000. You can contribute to both a traditional IRA and a Roth IRA in 2021, but your total contributions cannot exceed these annual limits.

View More

All About IRAs

June 11, 2021

An individual retirement arrangement (IRA) is a personal retirement savings plan that offers specific tax benefits. In fact, IRAs are one of the most powerful retirement savings tools available to you.

View More

Be Inspired. Be Inspirational

June 10, 2021

There is a lot going on here so take a few moments to really look at this photo. What Do You See? Get Inspired by everything that you see. Then take that Inspiration with out into your world.

View More

Bear Markets Come and Go

June 9, 2021

The longest bull market in history lasted almost 11 years from 2009- 2020. Then coronavirus fears and the realities of a seriously disrupted U.S. economy brought it to an end. If you are losing sleep over volatility driven by a cascade of disheartening news, it may help to remember that the stock market is historically cyclical.

View More

Facing the Possibility of Incapacity

June 8, 2021

Incapacity means that you are either mentally or physical unable to take care of yourself or your day-to-day affairs. Incapacity can result from serious physical injury, mental or physical illness, advancing age, and alcohol or drug abuse.

View More

Bonds, Interest Rates, and the Impact of Inflation

June 5, 2021

The ups and downs of the bond market can have a significant impact on your overall bond portfolio return. If you are considering investing in bonds it is important to understand how bonds behave and what can affect your investment in them.

View More

Higgins Capital Talks Tips for Managing Your Money.

June 4, 2021

With financial matters, success is based on a systematic and disciplined approach. Spending time to maintain your program, can help you keep track of progress as you pursue your financial goals.

View More

How Much Annual Income Can Your Retirement Portfolio Provide?

June 2, 2021

Your retirement lifestyle will depend not only on your assets and investment choices, but also on how quickly you draw down your retirement portfolio. Figuring out an appropriate initial withdrawal rate is a key issue in retirement planning and presents many challenges.

View More

Annuity Basics and Your 401k or IRA Rollover

May 28, 2021

Can An Annuity Work For You in a Rollover? Learn about Annuity Basics. In its simplest form, you pay money to an annuity issuer, and the issuer pays you back the principal and earnings at some point in the future.

View More

Watch This Great Video! Memorial Day is Here!

May 27, 2021

Celebrate Our Great Heritage! Memorial Day Weekend is Here. The Day is the American Holiday Honoring Our Men and Women Who Died While on Active Duty in The United States Military.

View More

Retirement Planning With Annuities

May 26, 2021

There are several considerations when planning retirement with annuities. They are1 How a Variable Annuity Works 2 Estimating Your Retirement Income Needs 3 Asset Allocation 4 Fixed vs. Variable Annuities.

View More

Annuities and Retirement Planning

May 25, 2021

You may have heard that IRAs and 401(k)s are the best ways to invest for retirement.But if you have maxed out your contributions to those accounts and want to save more? An annuity may be an appropriate investment to look into.

View More

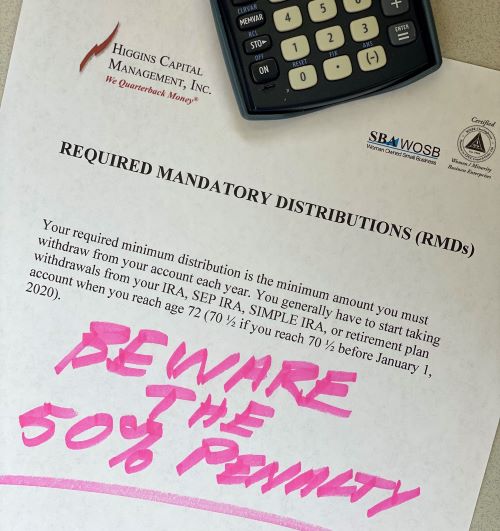

Required Minimum Distributions (RMDs)

May 21, 2021

What Are Required Minimum Distributions (RMDs)?Required minimum distributions, often referred to as RMDs or minimum required distributions, are amounts that the federal government requires you to withdraw annually from traditional IRAs and employer-sponsored retirement plans.

View More

Retirement Account Rollovers REDUX

May 19, 2021A rollover is the movement of funds from one retirement vehicle to another. You may want to make a rollover for any number of reasons. There are two possible ways that retirement funds can be rolled over — the indirect (60-day) rollover and the direct rollover (or trustee-to-trustee transfer).

View More

Investing Basics and Your Retirement

May 18, 2021

The more you can save for retirement, the better your chances of retiring comfortably. Before investing for your retirement, you should set retirement goals and also consider your time horizon, risk tolerance, and liquidity needs.

View More

I think it's time to start planning for retirement. Where do I begin?

May 14, 2021

Although most of us recognize the importance of sound retirement planning, few of us embrace the nitty-gritty work involved. With thousands of investment possibilities, complex rules governing retirement plans, and so on, most people do not even know where to begin.Here are some suggestions to help you get started.

View More

This is National Etiquette Week. Celebrate and Change The World!

May 13, 2021

This is National Etiquette Week. Celebrate and Change The World! Help Change The World With Two Words At A Time. Thank You, You're Welcome, Yes Ma'am. Yes Sir.

View More

Taking Money Out of Your 401k - Not As Easy As Putting It In

May 12, 2021

In-Service Withdrawals from 401(k) Plans. You may be familiar with the rules for putting money into a 401(k) plan. But are you familiar with the rules for taking your money out? Federal law limits the withdrawal options that a 401(k) plan can offer. Your plan may be more restrictive with fewer withdrawal options than the law allows.

View More

401(k) Plan Fees – There Is No Free Lunch

May 11, 2021

If you direct your own 401(k) plan investments, you'll need to consider the investment objectives, the risk and return characteristics, and the performance over time of each investment option offered by your plan in order to make sound investment decisions. Fees and expenses are factors that may affect your investment returns, and therefore impact your retirement income.

View More

NOOD Racing at San Diego Yacht Club

May 10, 2021Kea Wins The NOOD for The 10th Time!Wind and salt spray in your face. San Diego Yacht Club's Racing Season is off to a fast start. Racers from around the country are anxious to shake off the lethargy of the past year and get on with living life.

View More

Retirement Planning Considerations for a Stay-at-Home Spouse

May 7, 2021

Married couples often decide together that one spouse should be the primary breadwinner while the other stays home to take care of family members. Although this often works out well for childrearing or eldercare responsibilities in the short term, it can present long-term retirement-planning risks for the stay-at-home spouse.

View More

Reaching Retirement: Now What?

May 5, 2021Planning For Remarriage

May 4, 2021

If you're planning to remarry, you must decide how you and your fiance will combine your households. Read about these 5-Issues.

View More

Neighbors Helping Neighbors

May 3, 2021

Read and Share This Uplifting Story about our Great American Traditions of Helping our Neighbors.

View More

Retirement Your Way. Experience The Higgins Capital Difference

April 29, 2021

Thinking Outside The Box has become the buzzword for more of the same logical thinking that limits your horizons.Retirement is your opportunity to do it Your Way. Let your imagination run free.

View More

Retirement Income: The Transition Into Retirement

April 28, 2021

Read This Thought Provoking Article on Retirement. A Successful Retirement Takes As Much Planning as A Successful Career.. The same thoughtful approach applies to retirement.

View More

What Rising Rates Could Mean for Your Money

April 27, 2021

After years of keeping the benchmark federal funds rate at historic lows, the Federal Reserve has been raising it gradually. Near-zero rates were an emergency measure, and gradual increases reflect greater confidence in the U.S. economy.

View More

Inflation Is Going Up

April 26, 2021Rising Inflation. Will You Be Able To Ride It Out?Inflation is going up. Prices are rising. Gasoline and real estate are the most obvious.

View More

Changing Jobs? Know Your 401(k) Options

April 23, 2021

If you have lost your job, or are changing jobs, you may be wondering what to do with your 401(k) plan account. It is important to understand your options. What will I be entitled to? If you leave your job (voluntarily or involuntarily), you will be entitled to a distribution of your vested balance. Your vested balance always includes your own contributions(pre-tax, after-tax, and Roth) and typically any investment earnings on those amounts.

View More

Celebrate Earth Day

April 22, 2021

Today We Celebrate the 52nd Anniversary of Earth Day. It was first celebrated in 1970 as the formal commitment of the United States to improving the environment and creating a sustainable future for all Americans.52-Years of Environmental Improvement.As Americans Let Us Celebrate The Great Work We Have Already Accomplished.

View More

Charitable Giving

April 21, 2021

When developing your estate plan, you can do well by doing good. Leaving money to charity rewards you in many ways. It gives you a sense of personal satisfaction, and it can save you money in estate taxes.

View More

Sudden Wealth

April 20, 2021

What would you do with an extra $100,000? What if you suddenly had an extra million or 10 million or more? Now that you have come into a windfall, answering these questions may help you evaluate your needs and goals.

View More

Nuts and Bolts: How to Roll Over Your Employer Retirement Plan Assets

April 16, 2021

There are two types of rollovers: direct and indirect.A direct rollover is paid from your plan directly to your IRA or to your new employers retirement plan. The funds are never payable to you.An indirect rollover is a payment made to you that you later roll over to an IRA or an employer retirement plan.

View More

We are 26-Years Old Today. Celebrate With Us!!

April 15, 2021We are 26-Years Old Today!! Celebrate With US!!Debbie and I founded Higgins Capital 26-years ago today. April 15, 1995. Take a moment and enjoy a quick retrospective of 1995.

View More

My Spouse Died Unexpectedly. Where Do I Stand?

April 14, 2021

My spouse just died. Do I have access to his or her accounts?Generally, if your name does not appear on the account, either as a joint owner with rights of survivorship, trustee (if the account is held in trust), or a beneficiary, you probably cannot access the account unless authorized to do so by the probate court having jurisdiction over the estate. Each state has its own laws dealing with this situation, and the applicable rules may differ from one state to the next.

View More

Life Insurance Basics

April 13, 2021

Life insurance is an agreement between you and an insurer. Under the terms of a life insurance policy, the insurer promises to pay a certain sum to a person you choose (your beneficiary) upon your death, in exchange for your premium payments.

View More

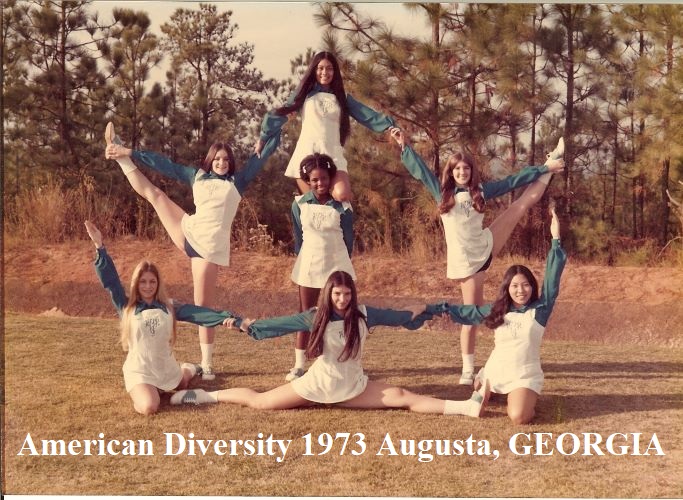

Our Great American Heritage of Diversity

April 12, 2021

Diversity 1973 Augusta, GEORGIA. As Americans we share a great cultural heritage of diversity and inclusion. We have always been the world's melting pot. We have always been the immigrant's dream. Celebrate Our Great Shared Heritage. Stand Tall. Be Proud.

View More

Robo Advisors Have Arrived, But Life Often Calls for a Human Touch

April 9, 2021

After years of development, numerous robo advisors have entered the world of investment management. Still, many investors may not fully understand exactly what robos do, or how they do it.

View More

Character Matters - Thoughts on Fulfillment

April 8, 2021

I asked a friend who has crossed 70 and is heading towards 80 what sort of changes she is feeling in herself? She sent me the following:

View More

Retirement Income Roadmap For Women

April 7, 2021

More women are working and taking charge of their own retirement planning than ever before. What does retirement mean to you?

View More

Introducing Our New StartUp-CatchUp Service

April 6, 2021

Introducing Our StartUp-CatchUp Service. We are a Beacon of Light for two Groups of Forgotten Investors. 1) Those trying to get started in working with a Financial Advisor 2) Those who realize that they do not have enough in retirement savings for the lifestyle they want.

View More

Working From Home May Not Be The New Normal

April 1, 2021

Working Remotely was supposed to be the future. Employees have left Silicon Valley, New York and other metropolitan areas in search of a better lifestyle based on the certainty that working remotely was here to stay.Think Again! There is pushback against working remotely … and it is growing.Google is the latest company to end the remote working dream.

View More

Women and Work: Why Salary, Benefits, and Work-Life Balance Count

March 31, 2021

As you progress along your career path, there is no telling how far you will go. But to fully reap the financial rewards of all your hard work, you will need to take charge of your own career. Here are a few issues you will want to pay close attention to.

View More

Evaluating a Job Offer

March 30, 2021

Evaluating a Job Offer If you are considering changing jobs, you are not alone. Today, few people stay with one employer until retirement. It is likely that at some point during your career, you will be looking for a new job. You may be looking to make more money or seeking greater career opportunities. Or, you may be forced to look for new employment if your company restructures.

View More

Fed Forecast: Low Rate Ahead. Insights for You

March 29, 2021Read This: Fed Forecast: Low Rates Ahead. Here Are Insights You’ll Want to Know.The Federal Reserve at its most recent meeting recommitted to keeping short-term interest rates near zero for the foreseeable future, which likely means into 2023 or 2024.The Fed is also all in; to do whatever it takes to support the economy. It has said that it will be willing to tolerate inflation above 2% for a time. That means that the Fed will not raise short-term rates ...

View More

Choosing a Beneficiary for Your IRA or 401(k)

March 26, 2021